Aftermarket retail spending up and thriving

The “three dragons” came together to offer insight during the annual AASA VISION Conference, but rather than breathing fire, instead they discussed how the pandemic has breathed new life into the aftermarket.

In “A Reprisal: The 3 Dragons Debate the Aftermarket’s Outlook,” three perspectives — that of the economist, the aftermarket analyst and a Wall Street analyst — were presented on the state of the aftermarket and what is expected for the future.

The economist

The pandemic is often compared to the recession of 2009. And while the U.S. saw a Gross Domestic Product (GDP) decline of 3.5 percent in 2020, compared to only 2.5 percent in 2009, the overall pictures, particularly for durable goods, are quite different, said Elizabeth Clark, Team Lead, Automotive, Office of Transportation and Machinery, Industry & Analysis with the U.S. Department of Commerce, International Trade Administration.

The COVID-19 pandemic caused a downturn, but not a traditional one, despite people treating it that way. If you look closer by sector, in 2008 and 2009, durable goods showed a decline of 5.7 percent and 6.1 percent, respectively, and not even a 1 percent decline in services. Fast forward to 2020, and durable goods saw an increase of 6.4 percent, while services decreased more than 7 percent.

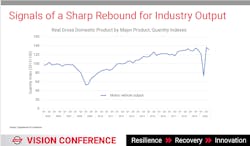

In 2008-2009, you saw more of a U-shaped, gradual recovery. However, 2020 shows a dramatic decline and then rebound — equating the decline to “just a blip,” Clark said (Figure 1). The strong V-shaped recovery bodes well for continued improvement.

There has also been a strong rebound for trade in both imports and exports. “Exports haven’t bounced back as much as we would like,” Clark said, but imports are back to pre-COVID levels through the fourth quarter of 2020.

From a global perspective, the United States did relatively better than most of the rest of the world. While the U.S. GDP was down 3.5 percent, there were more significant declines in other countries including Mexico, down 8.5 percent, India, down 7.4 percent and the European area, down 6.8 percent.

“Going into the future, things are looking really good for us,” Clark said. The U.S. GDP is expected to grow 6.5 percent, which is a huge growth for the country’s size. Another 4 percent growth is currently anticipated in 2022, she said.

However, “it may mean we need to keep an eye on the export picture, as the rest of the world has not recovered quite as well,” Clark said.

The aftermarket analyst

“The reality of what happened with retail was not what I would have expected,” said Nathan Shipley, executive director, automotive, with The NPD Group. As consumers spent more time at home, they more fervently began tackling DIY projects, trying to get an old car up and running or buying a boat to go travel with family, all activities not typical in a “downturn.”

Retail aftermarket performance saw a spike in early March 2020 as people were gearing up to stay at home, followed by a massive drop at end of month. In late April, the story turned around when the first stimulus rolled out, Shipley said. Then from late April to mid-June, there was unprecedented growth in the industry, but not with what would be deemed typical growth drivers.

Rather than seeing a boost in as-needed products, the biggest spikes came from recreation and DIY/Discretionary spending — categories that consumer typically don’t have to, but wanted to, spend in.

Consumers could gift sporting event tickets or go on trips, so instead they turned to retail spending for gift giving around Mother’s and Father’s Day, Shipley said. Sales came to a peak in mid-June and a sustained growth rate of 10 percent sustained through the summer months (Figure 2).

As the weather started moving into the cooler months and it started getting darker earlier, there was again a slight drop. But in January with the second stimulus, retail aftermarket sales again peaks. Overall automotive retail dollars were up 6.6 percent in 2020.

Thinking ahead in the short term, Shipley said the fundamentals of the industry remain strong, specifically the average vehicle age, gasoline prices, suppressed new-car sales, vehicle longevity and increased miles driven expected in 2021, as compared to 2020.

However, consumer behaviors are transitioning, with more commuting and less road trips returning, less time for projects and recreation, but also more locked in DIY behavior from equipment purchases — specifically workout equipment keeping people out of gyms, tools driving at-home projects, and automotive maintenance equipment spurring more DIY vehicle maintenance.

Shipley does stress the importance of the aftermarket creating a seamless customer experience. Ecommerce continues to grow, so the importance of aftermarket in-store expertise is more important now than ever in countering that impact.

The Wall Street Analyst

Continuing on the industry success outlined by Clark and Shipley, the Wall Street perspective showed a 7 percent increase in auto parts retailer store sales in 2020, with another 3 percent increase expected in 20201, said Seth Bashman, managing director, hardlines retail equity research analyst with Wedbush.

Miles driven did see a 13 percent decline in 2020 on a national basis, but it is expected to rebound at least 7 percent in 2021, with many factors, including inflation and weather, working in favor of this trend. Americans are also becoming more comfortable traveling to social gatherings and other recreational events, and commuter miles are starting to increase as well, further driving this trend.

Despite all the growth in automotive retail sales, auto parts retail stock performance has not performed all that well, Bashman said. Stock values are up but have underperformed in the broader market. This means, he explained, that investors do not think the spending increases that have happened over the past 18 months are sustainable long term. While investors anticipate spending levels to revert back to lower levels, Bashman said his firm thinks this view is misguided. Some of the trends impacting retail spending will continue into the future, so valuation levels are low when compared to the S&P 500,” he said.

About the Author

Krista McNamara

Krista McNamara is the former Editorial Director for the Vehicle Repair Group at Endeavor Business Media. She oversaw five brands — Motor Age, PTEN, Professional Distributor, ABRN and Aftermarket Business World. She worked in the automotive aftermarket industry for more than 15 years.