It’s been about three years since the last "full-sized" annual MACS event took place (that was in Nashville, in February 2020). And now that COVID-19 is mostly in the rear-view mirror, things at our 2023 Training Event and Trade Show did finally seem to be getting back to normal.

MACS 2023 took place at Nashville’s Gaylord Opryland Resort, where we had 31 speakers teaching 41 hours of mobile A/C classes over three days. This year we focused more on A/C for the EV market, as many OEMs indicated many more EV models being offered in the coming years.

Now, I know what you must be thinking; we’ve heard all this before, “The EVs are coming, the EVs are coming.” And we have the same thoughts. But when you investigate the data, there are clear lines that can be drawn along the path to the ever-increasing numbers of EVs on the road.

Reading into the data

Each year at the MACS event, we get an update from the industry’s two largest data suppliers, Experian and IHS Markit (now a part of S&P Global), and each one told a similar story with graphs and charts to back them up. In 2020, hybrids made up around 3.4 percent of new registrations, which increased two years later to 7.4 percent. Pure EV registrations made up 1.8 percent in 2020, which increased to 3.1 percent in 2021 and 5.6 percent in 2022. That's a 49.4 percent increase in just 1 year!

Sure, those numbers are still small in comparison to the overall market, but they indicate… they’re coming!

So, why do we care about EVs in the mobile A/C space? Because “air conditioning systems” are developing into “thermal management systems.”

Traditionally (up until Nissan integrated a heat pump system into the 2013 Leaf to increase driving range during the winter months), the sole reason for air conditioning systems in light-duty vehicles was to provide passenger comfort. But as the industry transitions to electrified vehicles, the "air conditioning" side of the system will have to do double-duty. Besides cooling the passengers, it will also have to cool the battery and power electronics, too.

But batteries don’t just like to be cool in the summer, they also like to be warm in the winter (just like people) and a heat pump system is ideal for doing this double-duty job.

Refrigerant update

Officially known as the American Innovation and Manufacturing Act, AIM gives EPA new authority to regulate the refrigerants we use in mobile A/C systems while also directing the EPA to issue new rules that restrict the use of Hydrofluorocarbons (HFCs).

What does this mean to aftermarket service and repair shops? A lot! As we reported last year, probably the biggest change we’ve seen so far is in the supply and price of refrigerant. You may remember that AIM directs EPA to phase down the production and consumption of HFCs across the American economy, and for us, that means less R-134a is going to be available. This alone is one of the biggest drivers in the price increase we've seen, but it's not over yet.

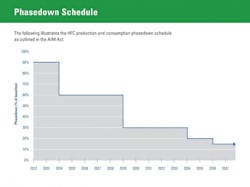

This chart shows the HFC phasedown schedule, which began at the end of 2021 (Figure 1). For the years 2022 and 2023, there was a 10 percent reduction in HFCs, which again is what drove the initial shortage and subsequent price spikes in refrigerant. Going forward, there is another stepdown which takes place in 2024. This will reduce HFCs by a further 30 percent (or a total reduction of 40 percent).

What's that going to do to price and supply? We can only speculate that we're going to see a similar reaction in the market as we saw in 2021. Distributors, jobber shops, wholesalers, and retailers are likely to be cautious with their sales to preserve availability, while also being super price conscious, as fluctuations are likely to occur. If things go the same way as they did last time, price and supply issues should settle out somewhat by summer 2024, but leading up to that the waters may be choppy.

AIM Act overview

The goal of the AIM Act is to phase down HFC production and consumption by 85 percent (by the year 2036). Within the category, 18 HFCs are listed as regulated substances (R-134a is just one of them). AIM authorizes EPA to address HFCs through an allowance allocation and trading program. It also facilitates sector-based transitions to next-generation technologies (in our case, R-1234yf) through restrictions on HFCs. Passenger cars and light trucks have pretty much all converted over to “yf” during the last 10 years. The rest of the mobile A/C industry is still using HFCs, but that is likely to change soon.

The EPA proposes a GWP limit for five MVAC subsectors

The mobile air conditioning industry has only seen R-1234yf refrigerant being used in passenger vehicles and light-duty trucks. And although MACS has reported on other subsectors which have been granted permission to use “yf” (such as medium-duty trucks, complete heavy-duty vans, and certain agricultural and construction equipment), to date, we have only seen R-134a being used in these systems. But when this new EPA rule takes effect, we're likely to see these vehicles switch over to using R-1234yf.

The U.S. EPA issued a new notice of proposed rulemaking (NPRM) on Dec. 7, 2022, which proposes to limit the global warming potential (GWP) of refrigerants used in newly manufactured vehicles in five subsectors of motor vehicle air conditioning (MVAC). These include:

- Light-duty passenger vehicles

- Medium-duty passenger vehicles

- Heavy-duty pickup trucks Complete heavy-duty vans

- Nonroad vehicles (agricultural and construction equipment)

The proposed GWP limit is 150, which is the same limit imposed by European regulators (and by the Kigali amendment).

What does this mean for each subsector?

On the light duty side, it means the EPA is requiring car makers to continue using a low-GWP refrigerant in their MVAC systems (Figure 2). Almost every passenger car and light truck being sold in the US today (with only a very few exceptions) has already switched away from R-134a and is now using R-1234yf. For those last holdouts, they'll be required to switch away from HFCs by the 2025 model year (which for some, means early 2024). For the remaining subsectors, it’s going to force a change.

Medium duty passenger vehicles, heavy duty pickup trucks, and complete heavy duty vans, (according to the EPA) are considered to be limited types of heavy-duty vehicles (Figures 3 and 4). EPA previously allowed the use of “yf” in these vehicle types, but so far none are using it.

The reason is due to cost. Most of these vehicles are vocational, meaning they're used for work. This makes them very cost-sensitive because like all things that go into "making something", cost matters. Cost matters to the company buying something to be used in the product or service they provide, and cost matters to the customer and the end-user, who ultimately purchases said product or service.

Also, there has not been a driving force making the manufacturers change.

For LD vehicles, the EPA tried to require OEMs to switch away from R-134a (a few years ago), and while their plan didn't work out, it wasn't the driving force anyway; CAFE credits were. There are no such credits outside of light-duty, so there has been no reason to switch (until now).

It's a similar situation regarding non-road vehicles, such as agricultural and construction equipment (Figure 5). This category is also broken down into a few types, which include:

- Agricultural tractors greater than 40 HP

- Self-propelled agricultural machinery

- Compact equipment

- Construction, forestry, and mining equipment

- Commercial utility vehicles (UTVs)

Just as with the “limited types of HD vehicles”, OEMs have also been allowed to use “yf” in these systems for some time now but have yet to do so. There has been no requirement, no credits, and of course, like always… cost matters.

It’s important to note that the EPA does not require the use of any specific refrigerant. All they’re saying is that beginning with the 2026 model year, OEMs will no longer be allowed to use a refrigerant with a GWP of more than 150.

And in case you were wondering, the proposed rule includes vehicles being manufactured in the US exclusively for export, along with electric vehicles. This includes light-, medium- and heavy-duty hybrids, plug-in hybrid electric vehicles, fully electric vehicles, and fuel cell vehicles.

Also please note, that there has not yet been a proposal to limit the use of HFCs in other types of HD vehicles, such as class 4-8 trucks, buses, school buses, and specialty vehicles. We do know, however, that a submission for the Significant New Alternatives Policy (SNAP) program is being worked on at the moment to evaluate possible substitute refrigerants for these vehicles. (ONLINE, link to this: Substitutes in Refrigeration and Air Conditioning | US EPA).

What are the benefits of this proposed rule?

The EPA estimates that the proposed rule (if finalized as written), would result in significant reduction of greenhouse gas GHG emissions while providing savings to American consumers and industry through energy efficiency gains and lower-cost alternatives. The proposal would result in cumulative GHG emissions reductions ranging from 134 to 903 million metric tons of carbon dioxide equivalent (MMTCO2e) through 2050. The EPA estimates that the cumulative net benefits of this proposed action are between $13.1 billion to $56.3 billion from 2025 through 2050. These numbers are for the entire HFC marketplace and are not just limited to MVAC.

Want to learn more about this proposed rule? Here’s a link to it on EPA’s website:

https://www.epa.gov/climate-hfcs-reduction/technology-transitions

For more information about MACS, please visit our website: